Managing cashflow effectively is essential for any business, and having flexible finance options can make all the difference. A Revolving Credit Facility (RCF) is one of the most versatile funding solutions available. Whether you’re covering seasonal fluctuations, funding growth, or managing working capital, an RCF can offer the financial breathing space your business needs.

What Is a Revolving Credit Facility?

A revolving credit facility is a flexible line of credit that allows businesses to borrow, repay, and borrow again up to an agreed limit, much like a business overdraft but often with more structure and better rates.

Instead of applying for new finance every time you need extra cash, an RCF gives you ongoing access to funds that you can draw down as needed. You’ll only pay interest on the amount you use, making it a cost-effective way to manage cashflow.

How Does It Work?

Here’s a simple example:

- Your business agrees a £250,000 revolving credit facility with a lender.

- You draw down £100,000 to cover a short-term cashflow gap.

- As you receive income, you repay £100,000 plus interest.

- If you need funds again later, you can borrow up to the £250,000 limit without reapplying.

This cycle of borrowing and repaying makes an RCF ideal for businesses with fluctuating income or expenses.

Key Benefits of a Revolving Credit Facility

- Flexible access to funds – Borrow what you need, when you need it.

- Pay interest only on what you use – Unlike a traditional loan, you’re not charged on the entire facility amount.

- Supports growth and cashflow stability – Useful for covering seasonal gaps, project costs, or unexpected expenses.

- Reusable funding – Once repaid, funds become available again without another lengthy application process.

- Faster access than traditional loans – Ideal for businesses that need quick, ongoing liquidity.

When a Revolving Credit Facility Might Be Right for Your Business

An RCF can be a great option if your business:

- Experiences seasonal cashflow fluctuations

- Needs working capital to support growth or expansion

- Wants a safety net to manage unexpected costs

- Prefers flexibility over the fixed structure of a term loan

Many businesses use an RCF alongside other finance products, like invoice finance or tax loans, to create a well-rounded funding strategy.

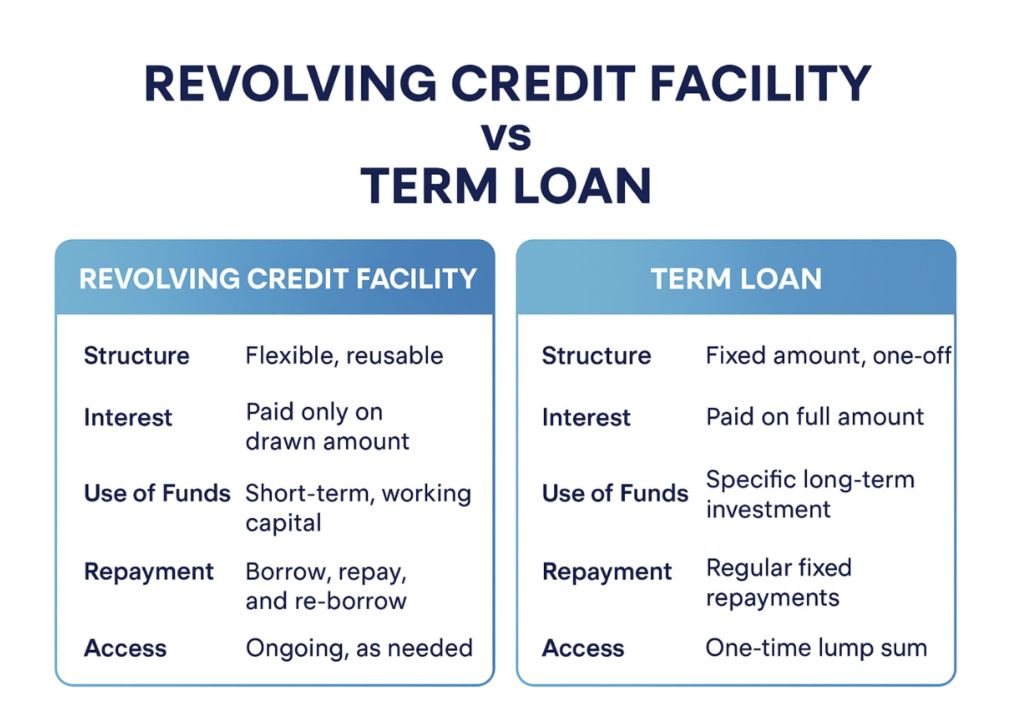

An RCF offers more day-to-day flexibility, while term loans are better for big, one-off projects like purchasing property or equipment.

Things to Consider Before Taking Out an RCF

Things to Consider Before Taking Out an RCF

While RCFs offer flexibility, it’s important to:

- Review the facility terms carefully – Check fees, interest rates, and repayment conditions.

- Manage usage wisely – Avoid relying too heavily on the facility for everyday expenses.

- Work with a trusted lender – A reputable partner, like Match Finance, can tailor the facility to suit your business goals.

How Match Finance Can Help

At Match Finance, we work with businesses to secure revolving credit facilities that fit their unique cashflow needs. Whether you’re looking for financial agility, growth support, or simply a safety net, our team can help you compare lenders and find the best structure for your business.

Get in touch with Match Finance today to discuss how a revolving credit facility could give your business the flexibility and confidence it needs to thrive.

- High-Growth Businesses and Borrowing - January 5, 2026

- Is It Better to Take a Business Loan to Pay HMRC Bills or Face Late Payment Interest, Fines and Bad Credit? - December 5, 2025

- Understanding Your Business Credit Score: Why It Matters & How to Improve It - October 16, 2025